Renewable energy will play key role in the Power Industry's outlook - Illustrative photo.

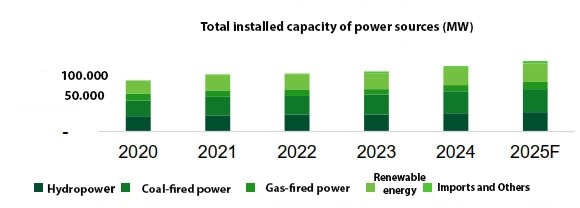

Evaluating the Power Industry's outlook, VCBS Research stated that, according to the power market operation plan, total power output is estimated to increase by approximately 11.3% in 2025 compared to the previous year. The total system output in the first five months of 2025 rose by 3% year-on-year. Therefore, it is highly likely that the annual output growth in 2025 will remain below double digits.

According to the National Center for Hydro-Meteorological Forecasting, there is a 55 - 90% probability that neutral conditions will persist and remain influential from May to November 2025. Due to the seasonal increase in hydropower availability during the latter half of the year, output from this source is expected to stay elevated.

VCBS Research estimates that in 2025, the power system’s peak load (Pmax) could reach 54.3GW, with the northern region accounting for up to 28.2GW. The northern region’s available generation capacity is estimated at around 29GW. Therefore, VCBS Research assesses that the power supply situation in the North will be highly strained in June and July, before gradually easing towards the end of the year.

Regarding additional capacity during the 2025 - 2027 period, VCBS Research noted that for solar power, the total additional capacity from 2025 to 2030 is estimated at around 54GW, with approximately 28GW expected to be concentrated in the Northern region. Existing power sources in the North may not be adequate to meet projected peak demand levels. Given the slow progress in developing large-scale power projects, the deployment of solar power emerges as a suitable solution due to its relatively short construction and commissioning time.

After 2030, solar power capacity in the Southern region is expected to grow significantly - by around 25GW - thanks to its advantages in solar radiation and high sunshine hours. For wind power, onshore and nearshore wind power capacity is expected to grow by about 16GW, distributed relatively evenly from the North to the South.

For hydropower, the additional capacity in the period 2025-2030 is estimated at about 2.1GW. Since most of the potential of large hydropower plants has been fully exploited, the remaining hydropower projects are only medium and small scale.

The total additional capacity from pumped-storage hydropower projects over the coming years is projected to reach approximately 3.6GW. For Vietnam's first pumped storage hydropower project, the Bac Ai pumped storage project is expected to generate 4 units in the 2029-2030 period. In early February 2025, EVN commenced phase 2 of the project, with a total investment of over VND 21,000 billion.

VCBS Research assessed that, with the revised target of increasing electricity consumption growth to approximately 10% per year, power generation sources must become a top investment priority. The revised PDP VIII underscores the continued importance of the 2050 Net Zero target, with solar and wind development serving as key instruments to achieve it.

In addition, to overcome the shortcomings of solar power in terms of stability, battery storage capacity has been added, with the requirement that solar power projects must invest 10% of the equivalent battery storage capacity.

Regarding preferential policies for renewable energy development, VCBS Research noted that the Government has issued Decree No. 58/2025/ND-CP, which details several articles of the Electricity Law related to the development of renewable and new energy power sources. In which, incentives for renewable energy and new energy projects are clearly stipulated as follows:

First, exemption from fees for using sea areas during the basic construction period, but not exceeding 03 years from the date of commencement of construction. 50% reduction in sea area usage fee for 09 years after the exemption period of the basic construction period.

Second, exemption from land use fees and land rent during the basic construction period, but for no more than three years from the start date of construction. After the exemption period during the basic construction phase, the exemption and reduction of land use fees and land rent shall be applied according to the provisions of the laws on investment and land.

Third, the minimum long-term contracted electricity output shall be 70% during the loan principal repayment period, but not exceeding 12 years, unless otherwise agreed between the investor and the power purchaser. For offshore wind power projects, the minimum long-term contracted electricity output is set at 80% during the loan principal repayment period, but not exceeding 15 years.

Fourth, renewable energy power projects with installed power storage systems and connected to the national power grid are given priority to mobilize during peak hours of the power grid according to regulations, except for self-produced and self-consumed power sources.

Regarding corporate income tax, VCBS Research believes that renewable energy projects will be eligible for tax incentives under Articles 15 and 16 of Decree No. 218/2013/ND-CP. Accordingly, power projects will be exempted from tax for 4 years, have a 50% reduction in tax payable for the next 9 years, and receive a preferential tax rate of 10% for 15 years.

Regarding investor selection through bidding, Decree No. 56/2025/ND-CP, issued on March 3, 2025, stipulates that renewable energy projects - such as solar, wind, hydropower, and biomass power - under the adjusted Power Development Plan VIII must undergo a bidding process when there are two or more interested investors.

Translator: Thanh Hải

Share