VND 20 trillion/year – a lot of difficulties

According to Mr. Nguyen Tuan Tung - General Director of EVNNPT, the construction investment amount from 2018 to 2030 of the Corporation is equal to the total investment volume for the entire transmission grid system so far. In which, there are many urgent transmission projects for the South with great pressure on the progress of capital arrangement, construction and disbursement, etc.

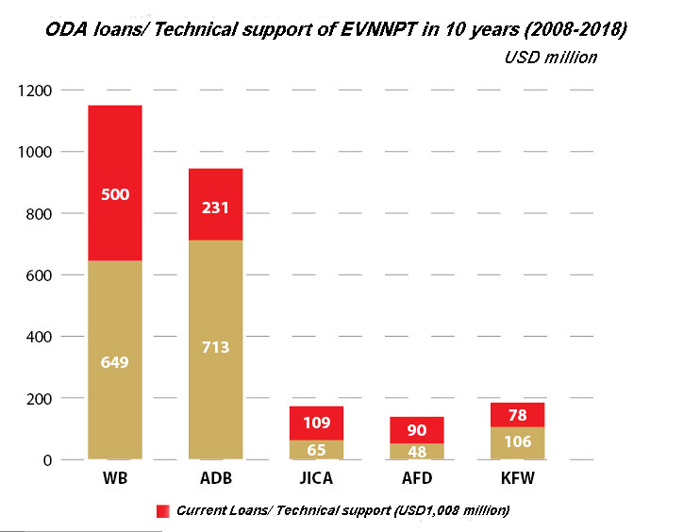

Currently, the financial situation of the Corporation is basically transparent, with financial criteria being ensured to be in line with current regulations and met the requirements of sponsors. However, there remain a lot of difficulties and challenges. Particularly, domestic large banks have provided EVNNPT loans at credit limit, short-term interest rates for USD are on the upward trend. In recent years, the Government has tightened ODA loans, limited foreign borrowing and in coming years, this situation will be more difficult. Access to foreign loans often takes a lot of time to negotiate with. Furthermore, in order to disburse this fund, EVNNPT has to complete many strict procedures, involving many Ministries and branches, with an average time of about 20 months/project. This is the “impossible-to-wait” period for urgent transmission projects.

Besides, currently, the power transmission unit price is applied subject to State’s regulation. The current unit price is only adequate to offset the costs of production, therefore, the Corporation is operating with almost no profit. Whereas, EVNNPT must preserve state capital in accordance with the regulations of the Ministry of Finance, comply with all guidelines under the financial mechanism applicable to one-member limited liability companies, must self-mobilize capital and take responsibility to pay the borrowed principal and interest under loan agreements.

From now to 2030, each year EVNNPT needs about VND 20,000 billion to serve investment in construction of power transmission grids

What solution?

According to EVNNPT’s leaders, in order to ensure capital sources for power transmission projects, in the coming time, the Corporation will actively work with traditional financial partners to mobilize ODA loans. These sources of capital are expected to account for about 50% of total investment capital in the next phase of EVNNPT. Additionally, the Corporation will continue to mobilize preferential foreign loans with low interest rate, extended borrowing period based on cooperative programs for 5-year or 10-year periods, or strategy of national development and sector development, annual unexpected programs being taken into account.

Particularly, EVNNPT will promote access to bilateral and multilateral trade capital sources, supporting the targets of ensuring sound financial sources when ODA and foreign preferential loans are limited. On the other hand, EVNNPT is also seeking opportunities with new forms of loans (export, trade, outcome-based credits, etc.), diversification of investment forms and efficiency optimization of foreign loans. The Corporation has made proposals to the Government, the Ministry of Industry and Trade, the Ministry of Finance to prepare a flexible option for borrowing guarantee, particularly foreign loans, to invest in power transmission projects with high investment rate, simplify administrative procedures, reduce time for arranging, completing and signing co-operation agreements, loan agreements, etc., to shorten implementation time and increase efficiency of the project.

At the same time, EVNNPT also determines, focuses on improving the efficiency of project management throughout the implementation process, particularly tightly controlling the construction and disbursement process, significantly contributing to the reasonable, efficient use of the to-be-allocated loans.

In addition to EVNNPT’s own efforts in mobilizing loans, enhancing the use efficiency of funds, according to financial experts, a radical solution is that state management agencies should consider adjusting the power transmission prices. The Corporation and its member units should recover capital, offset production costs, make reasonable profit, enhance “internal capacity”, create autonomy in all activities and financing, encourage to improve the efficiency of production -business.

evn.com.vn

Share