The power sector has a significant impact on the national energy security, so the equitization, registration of share trading and the divestment of state capital in companies in this sector meet big difficulties as well as “careful selection” of investors.

However, recently, the determination to accelerate the equitization and listing of the businesses in the power sector has shown great efforts of the units, which has also received great attention from domestic and foreign investors.

Liberalization of power sector

According to the report of Viet Capital Securities, the first step in the liberalization of the power sector is the operation of the competitive power generation market (CGM) from 2012. By the end of 2017, 80 power plants directly jointed CGM with a total capacity of 22,432MW, accounting for 52.8% of total installed capacity.

However, the openness of the competitive power generation market is not high and the in-feed price of the units still depends heavily on the fixed price of the power purchasing aggrement (PPA). According to the roadmap, the market penetration is only 10%, it will be increased to 15% in 2018 and can be up to 40% in the next few years, creating a better price and revenue for companies with low cost.

Following the development of the CGM, the Ministry of Industry and Trade has executed the pilot operation of the Competitive Power Wholesale Market (WCM) from 2016 in the form of simulated calculations but no real payment is made.

Starting in 2018, the state will put into operation a pilot WCM with real payments for a portion of power output purchased at source by the utility corporations and is expected to be officially implemented from 2019. to the third stage is the competitive retail market (RCM).

Regarding the growth potential of the power sector, according to a report of VCSC, the power consumption in 2017 is about 159 billion kWh and the growth rate of power consumption is expected to be at double digits over the next few years, which is higher than the growth rate of GDP.

The industrial production will be the main driving-force of the growth in power demand while FDI is rising sharply. FDI capital for manufacturing sector accounts for two thirds of total registered FDI and doubled in the last four years.

Retail power price in Vietnam is currently 50% lower than countries’ in the Asia-Pacific region and is expected to increase by from 7.6 to 9 USD cents in 2020. In addition, the increase of GDP per capita shall also support the liberalization of the power sector.

Many businesses are emerging

With the State’s active liberalization of the power sector, investment opportunities in power companies are also higher and the approach to buy shares is easier.

Electric power shares started to be more mentioned as two leading power corporations in Vietnam namely PV Power and EVNGENCO3 conducted IPO at the same time; along with the attention paid towards many other power stock codes.

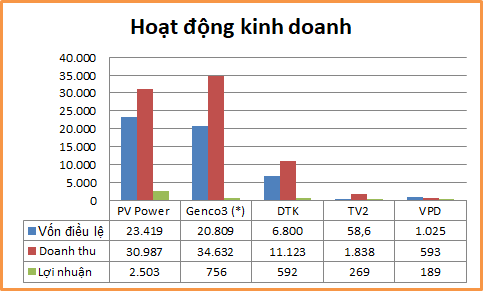

Business activities of some power companies

(*: GENCO3 data is parent company’s estimation).

The first power company conducting IPO of 2018 is Petrol Vietnam Power Corporation (PV Power - UPCoM: POW), which attracted many investors. As many as 1,928 investors won the bid to buy all 468.37 million shares auctioned.

After the IPO, PV Power also quickly registered trading on UPCoM on March 6th, 2018 and the POW code increased sharply. Ending the first trading day, POW closed at VND17,800/share, 19.5% higher than the reference price.

Besides to the public offering, PV Power shall sell to strategic investors 28.88% of the total shares, equivalent to 676.38 million of shares. The Representative of POW said that four investors have submitted their share purchase proposals.

PV Power is the second largest power producer in Vietnam, operating 8 power plants with the total capacity of 4.2GW. In 2017, PV Power’s output reached 20,581 million KWh, exceeding 2.4% of the plan; total revenue of the corporation reached VND30,987 billion (equal to 106% of the plan), the before-tax profit reached VND2,503 billion (equal to 183% of the plan).

The other big business in the power sector also conducting IPO thereafter is the parent company - Power Generation Corporation 3 (EVNGENCO3). Recently, EVNGENCO3 has made IPO with an average winning price of VND24,802/share. In the coming time, this business is going to continue offering shares to strategic investors with a 36% offering rate. If it gets successful, the selling value in the next IPO is estimated to be at least VND18,500 billion. It is known that at least four investors are large businesses in the power sector in the world has registered to participate in auctions.

EVNGENCO3 is the largest operator of power plants in Vietnam (excluding EVN) with a total capacity of 6.3GW, accounting for over 16% of Vietnam’s electric power capacity with typical plants such as Phu My and Mong Duong, Vinh Tan, etc.

The current capacity structure of EVNGENCO3 is equally distributed in gas-fired power, coal-fired and hydropower. Power plants include four gas-fired power plants, three hydropower plants and two coal-fired thermal power plants and two thermal power plants and three hydropower companies owned by EVNGENCO3 at 30% of the total capital.

The performance of EVNGENCO3 is improving sharply, its estimated turnover in 2017 is VND34,632 billion and its pre- tax profit is VND756 billion by parent company’s pre-tax profit (profit growth of 99.8%). The debt problem, the weakness of EVNGENCO3, has been also solved when the corporation is implementing many solutions such as issuance of international bonds,etc.

The stock code of Power Engineering Consulting Joint Stock Company 2 (HNX: TV2) has gained strong attention lately when it reached the leading EPS position of the stock market in 2017; That shows that the power business stocks can still bring in a very good profit for the investors.

TV2 quickly rose from VND140,000/share (early 2018) soared to historic peak of VND243,600/share (8/3). Trading volume ranged from an average of 16,000 units/session/year to an average of 66,000 units/session in the last 6 sessions, which means that the average volume has increased by 4 times.

Although TKV Power Corporation (Vinacomin Power - UPCoM: DTK has no liquidity for long term, it is likely to be dynamic if Vietnam Coal - Mineral Industries Holding Corporation Limited (Vinacomin) divests 235.8 million shares (34.68%) and reduces its ownership proportion to 65% as planned.

The stocks of Vietnam Power Development JSC., (HoSE: VPD) were also paid attention to when being cancelled UPCoM registration for listing on HoSE on 22th January 2018. In addition, Tuan Loc Construction Investment JSC., also purchased 4.93 million shares of VPD right before the change date of stock exchange.

The stocks of power sector have long been considered so prudent in selecting investors, but major changes in the liberalization of the power sector as well as the emergence of large businesses shall create more attractive investment opportunities for the investors in the coming time.