Following up the equitization process of the major power generation corporations in the country, Power Generation Corporation 2 (EVNGENCO 2) also prepares for its initial public offering (IPO). EVNGENCO 2 is a one- member limited liability company, with 100% charter capital owned by Vietnam Electricity (EVN). EVNGENCO 2 has officially come into operation since 1 January, 2013 consisting of 8 units accounting depending on the parent company, 1 subsidiary with 100% of charter capital and 5 affiliated companies with 50% of charter capital owned by the parent company.

Currently, EVNGENCO 2 manages 8 power source investment projects including Thermal power of O Mon 1, 2, 3, 4; Hydropower of Song Bung 2, Song Bung 4, Trung Son, Thac Mo expansion. The main business of EVNGENCO 2 is production and trading of power, power engineering; capital investment and management of power source projects; formulation and preparation of investment in construction, project management consultancy, supervision of work construction and installation, etc.

EVNGENCO 2 is the fourth power generation corporation privatized after TKV Power Corporation (UPCOM: DTK); Petrovietnam Power Corporation (UPCOM: POW) and Power Generation Corporation 3 (UPCOM: PGV). The privatization implemented after other generation corporations will facilitate EVNGENCO 2 to prepare for and overcome the shortcomings, but it is also a great pressure for the equitization to get successful like its peers.

Currently, EVNGENCO 2 has made great progresses in equitization and information disclosure. So what are the highlights helping EVNGENCO 2 get "noticed" in the eyes of investors?

Holding many efficient subsidiaries

As the plan of arranging and restructuring member enterprises, in addition of Trung Son Hydropower’s 100% capital, EVNGENCO 2 holds 51% or more of dominant shares in 5 other power companies.

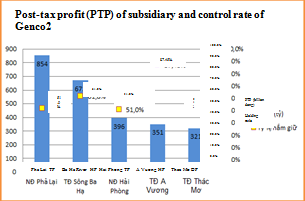

Profits of subsidiaries and dominant power of EVNGENCO 2

Owning 51% share in Pha Lai Thermal Power JSC., (HOSE: PPC): With holding 51.9% of PPC's chartered capital, EVNGENCO 2 gains a large revenue from the consolidation of business results of this thermal power company. In 2017, PPC's after-tax profit reached VND 854 billion, increasing 54% compared to that of year 2016, the result is gained mainly thanks to the sharp increase in power output.

Owning 51.92% of capital in Thac Mo Hydropower JSC., (HOSE: TMP), TMP's profit has grown 3 times in 2017, reaching VND 321 billion.

Owning 51% share in Hai Phong Thermal Power Subsidiary (UPCOM: HND): In 2017, HND grew 38% in profit, reaching VND 396 billion.

Another newly-listed subsidiary is A Vuong Hydropower JSC., (UPCOM: AVC) with the profit dramatically increasing nearly three times up to VND 351 billion. EVNGENCO 2 holds a very large ownership ratio accounting for 87.45% of AVC's capital.

The last subsidiary held by EVNGENCO 2 is Ba Ha River Hydropower JSC., which gained an impressive profit of VND 672 billion in 2017, three times higher than the targeted plan. EVNGENCO now is holding 61.78% of the company's capital.

Additionally, EVNGENCO 2 holds 100% capital of Trung Son One Member Hydropower Company Limited owning a power plant with a very large average annual power output of more than 1 billion kWh, thus making a significant contribution to revenue and profit for the Corporation.

The subsidiaries under EVNGENCO 2 operate quite efficiently with a large profit contributed to EVNGENCO 2; this is a highlight in the views of investors.

Many promising projects

EVNGENCO 2 also promotes investment in many new projects; thus, it is expected to create a growth momentum in a long term.

For Trung Son Hydropower Project, EVNGENCO 2 is completing other work items and continues to conduct the project’s final account before 30 June, 2018. So far, 2/4 generation units of this project have been generated for power. This is a large invested work with a total investment of over VND 7,775 billion (about USD 411 million), of which USD 330 million is funded by the World Bank with a maturity of 27 years.

Song Bung 2 Hydropower Project is grade-II hydropower work, which is expected to be put into use in August 2018. The plant has an installed capacity of 100MW with average annual power output of 425.57 million kWh; including 2 plant units, the total investment in work is more than VND 3.654 billion.

O Mon Power Center is invested to construct 04 factories with the total capacity of 2,910MW. At present, EVNGENCO 2 is completing the final settlement account report for completion phase 2 for O Mon I & II Thermal power plants; completing the handing over of O Mon III & IV projects to Ninh Thuan Nuclear Power Project Management Unit in quarter I/2018.

EVNGENCO 2 also invests in wind power such as Cong Hai 1 Wind Power Project; Huong Phung 1 Wind power Plant or invests in expansion of basin to supplement water for Quang Tri Irrigation - Hydropower work and the downstream area, etc.

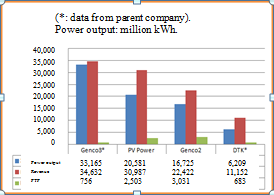

Over VND 3,000 billion of pre-tax interest

Although EVNGENCO 2 is not the leading unit in terms of power output, it shows efficiency from its business with consolidated revenue reaching VND 22,422 billion and pre-tax profit of VND 3,031 billion in 2017, the highest level reached among power generation corporations that have conducted equitization. The total amount contributed to the state budget is VND 2.120 billion.

In 2017, EVNGENCO 2 announced that the total output of power produced was 16.725 million kWh (excluding oil thermal power), growing by 10.15%, but it was only equal to 96.79% of the year’s plan. The reason for failing to complete the plan is due to the suspension of the Vietnam competitive generation market in October 2017, which has caused a great impact on the coal-fired thermal power of the Corporation.

In 2018, when Song Bung 2 Hydropower Plant is put into operation, the planned power output of EVNGENCO 2 is expected to slightly increase to 16,787 million kWh. As a result, the total planned revenue reaches VND 22,417 billion.

Its consolidated pre-tax profit in 2018 of the company is estimated at VND 1,390 billion. However, this is only temporary data, the plan will be adjusted after the plan of joint stock companies has been approved in the 2018 Annual General Meeting of Shareholders. The total amount contributed to state budget is expected to be equal to 2017 at VND 2,120 billion.

Thus, the profitability/revenue ratio of EVNGENCO 2 has shown more efficiency than other corporations. This is also a highlight and an important factor in the business activities to attract investors.